More Families Soon To Qualify For Chapter 7 Bankruptcy

Photo by: torbakhopper at Flickr

Photo by: torbakhopper at Flickr

Do you need to file a chapter 7 bankruptcy? Do you make too much money? Beginning November, rule changes will allow a few more higher income households to file Chapter 7 bankruptcy in California.

Too Rich To File Chapter 7?

One hurdle to a bankruptcy discharge in a Chapter 7 is the "means test". This test guards against bankruptcy abuse--those debtors that can afford to pay back their creditors. The "means test" analyzes your household income and expenses. The goal is to determine whether you can pay back your creditors. "Passing" means it is presumed you cannot. "Flunking" means you may be able and may need to file bankruptcy under another chapter, like a Chapter 13 bankruptcy.

Step One: How Much Do You Make?Below is the newest median yearly income for a households in California, effective November 1, 2014:

If your single and your gross income is less than $49,185, than you pass. (See the graph above.) If you live with a spouse, you and your spouses combined grossly income must be below $63,745. And so on...

If household income, compared to family size, exceeds the numbers permitted in the graph, further "testing" is required. You will need to deduct permitted household expenses.

Step Two: Analyze Monthly Expenses

The amount a household earns is just one factor. If your family income exceeds the permitted median income listed above, you may still be able to pass the means test. This part of the means test is too fluid and therefore too complicated to attempt to explain it in a blog. You will want a bankruptcy attorney take over at this point. However, here is a quote from the Department of Justice about analyzing household expenses inside the "means test":

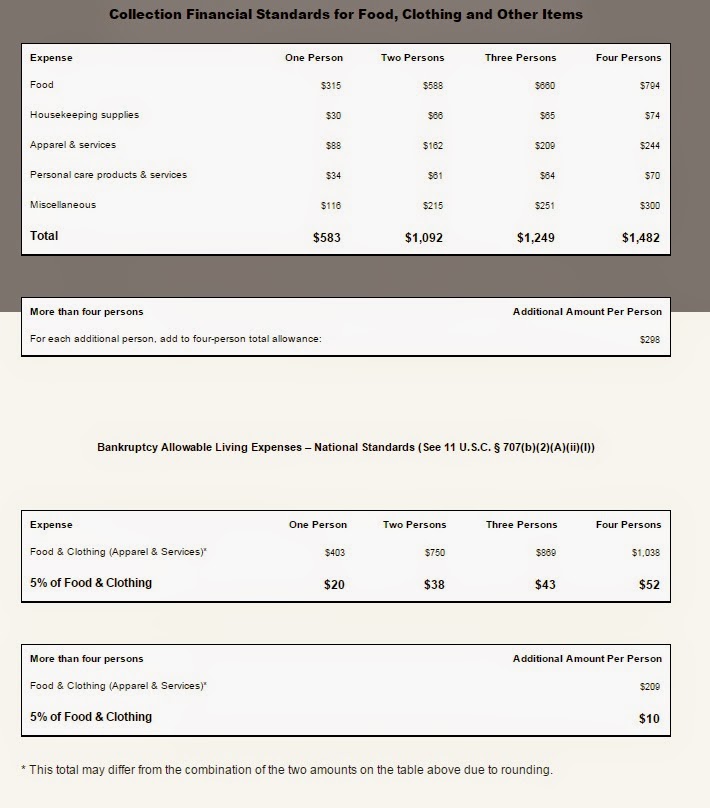

National Standards for food, clothing and other items apply nationwide. Taxpayers are allowed the total National Standards amount for their family size, without questioning the amount actually spent.

National Standards have also been established for minimum allowances for out-of-pocket health care expenses. Taxpayers and their dependents are allowed the standard amount on a per person basis, without questioning the amount actually spent.

Maximum allowances for housing and utilities and transportation, known as the Local Standards, vary by location. In most cases, the taxpayer is allowed the amount actually spent, or the local standard, whichever is less.

Generally, the total number of persons allowed for necessary living expenses should be the same as those allowed as exemptions on the taxpayer’s most recent year income tax return.

If the IRS determines that the facts and circumstances of a taxpayer’s situation indicate that using the standards is inadequate to provide for basic living expenses, we may allow for actual expenses. However, taxpayers must provide documentation that supports a determination that using national and local expense standards leaves them an inadequate means of providing for basic living expenses.

Copied from Department of Justice, Trustee, website on October 17, 2014

Because the analysis is so fluid, you will want to analyze your monthly expenses with a bankruptcy attorney. As a starting point, here is the present national standards for food clothing and other items:

Copied from Department of Justice, Trustee, website on October 17, 2014

Sometimes, even when you "flunk" the means test, the court could consider your specific circumstances that will allow you to file chapter 7 bankruptcy. A common one relates to permitting additional expenses that relate to treating a medical condition. Bottom line, consult with an expert to effectively navigate the "means test".

Updated daily, this blog will keep you informed on the latest bankruptcy news!

Updated daily, this blog will keep you informed on the latest bankruptcy news!  Learn more about how Bankruptcy works and what you need to know.

Learn more about how Bankruptcy works and what you need to know.